Car Donation

Support our work and our mission

Donate a vehicle

The Arc’s car donation program supports our efforts in ensuring that people with disabilities enjoy full participation in the community and are granted the same respect, equality, and security as every member of society.

The Arc carries out its mission of protecting and promoting the rights of people with intellectual and developmental disabilities (IDD) and their families through innovative programs. Our initiatives touch almost every aspect of life in the community. By sharing our knowledge and conducting trainings and events, our programs help connect communities and inform efforts to broaden inclusion across the country.

We accept all types of vehicles

Car * SUV * Truck * Motorcycle * RV * Boat * ATV

How it works

The Arc accepts cars, vans, trucks, boats with a trailer, and recreational vehicles seven days a week, 24 hours a day. It’s as simple as filling out our online donation form. You must be able to provide: the year, make and model of your vehicle, the general condition, the vehicle identification number, and have the title and lien in hand. The Arc will take care of the rest and arrange a convenient time for free auto towing. Your tax form will be mailed to you within four to six weeks documenting your Non-Cash Charitable Contribution.

Benefits of donating your vehicle

- Free towing whether your vehicle is running or not.

- You can donate your automobile from anywhere in the country.

- Eliminates the hassle of repairing, advertising and selling your car—let our courteous, trained staff handle all the details.

- Potential IRS tax deduction.

- Supports The Arc’s vision for a world where people with disabilities are fully included—your donation directly supports our advocacy, programs and services.

Maximizing your tax deduction

Car donations made to a charitable nonprofit organization are tax-deductible. The best practice is to consult with a tax professional on how to maximize your tax deduction since every car donation and tax situation is unique.In general, the IRS limits the tax deduction to the gross proceeds from the sale of the car, truck or other vehicle.

Charitable contributions must be itemized on Schedule A of Form 1040 to qualify. If the total deduction claimed on the tax return exceeds $500, Form 8283 “Non-cash Charitable Contributions” must also be completed and attached to your tax returns.To learn more about what a donors responsibilities are prior to making a car donation, please consult IRS Publication 4303 “Donors Guide to Vehicle Donations.”

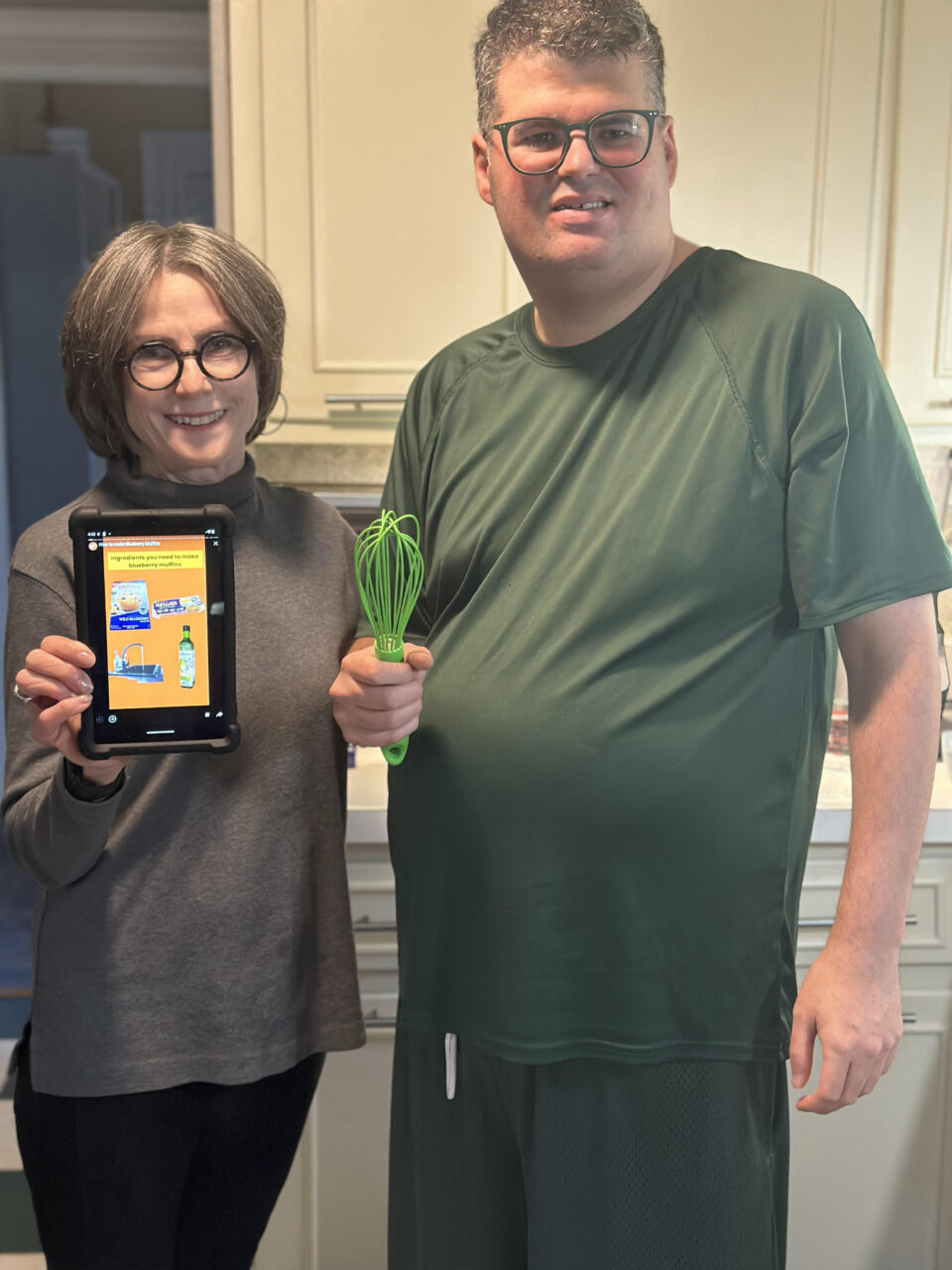

Testimonials

Expressions of gratitude from families who have been helped by your support

For more information on supporting The Arc of Northern Virginia, please contact

Howard Stregack, Director of Development,

at 703-208-1119 ext. 123

or email HStregack@TheArcofNoVA.org.

The Arc of Northern Virginia (Tax ID# 54-0675506)

Donation Refund Policy

We are grateful for your donation and support of our organization. Financial donations are normally nonrefundable. However, if you have made an error in making your cash or credit card donation, or change your mind about contributing to our organization, please contact us. Refunds are returned using the original method of payment. If you made your donation by credit card, your refund will be credited to that same credit card.

Stay Informed with the Latest News and Updates